J.P. Morgan Investing Bonus Updates

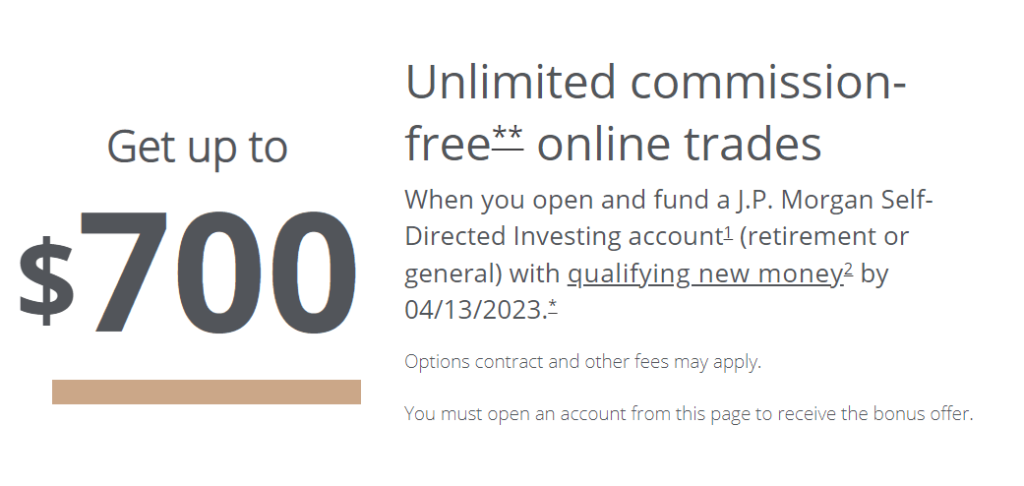

Update on January 13, 2023 – J.P. Morgan is now offering up to $700 bonus and has extended the bonus April 13, 2023. Bonus and funding tier has also changed and the article has been updated to reflect that.

J.P. Morgan Wealth Management

J.P. Morgan Wealth Management is offering up to $700 bonus when you open a Self-Directed Investing account and fund it with qualifying new money and maintain that fund for 90 days. This is a tiered bonus with the bonus amount dependent on the qualifying new money you deposit.

- Get $50 bonus when you fund with $10,000 – $24,999

- Get $150 bonus when you fund with $25,000 – $99,999

- Get $325 bonus when you fund with $100,000 – $249,999

- Get $700 bonus when you fund with $250,000+

J.P. Morgan Self Directed Investing offers commission-free online trades for U.S. listed stocks and Exchange-Traded Funds (ETFs). Option trades are subject to a $0.65 per-contract fee.

The bonus is valid for General Investment, Traditional IRA and Roth IRA accounts.

J.P. Morgan Self Directed Investing Bonus Summary

Bonus – $50 or $150 or $325 or $700

Funding Requirement – $10,000 or $25,000 or $100,000 or $250,000

Offer Expiry – April 13, 2023

Promo Code – Generated at the Link

Inactivity Fees – None

Link for the Offer

Brokerage Bonus Requirements

- Open a J.P. Morgan Self-Directed Investing account through this page before the bonus expiry date.

- Fund the account with either $10,000 for $50 bonus, $25,000 for $125 bonus or $100,000 for $300 bonus or $250,000 for $625 bonus within 45 days of account opening.’

- Maintain that fund for the next 90 days.

- Bonus will post within 15 days after 90 days has passed.

Inactivity Fee | How to Avoid It?

- There is no inactivity fees.

BonusCoach’s List of Best Brokerage Bonus

Early Termination Fees

There is no early termination fees. But you have to hold the fund for 90 days to receive the bonus.

The Fine Print

- Offer eligibility and restrictions: Cash promotion is limited to one per customer and can only be applied to one new J.P. Morgan Self-Directed Investing account (General Investment, Traditional IRA, or Roth IRA). To enroll in the up to $625 offer, you must open an account through this page. This offer does not apply to J.P. Morgan Automated Investing or any account opened with a J.P. Morgan Advisor. You can only participate in one J.P. Morgan Self-Directed Investing new money bonus in a 12 month period from the last bonus coupon enrollment date. Coupon is good for one time use and only one bonus per account.

- To receive the cash bonus:

- Customers must open and fund a new J.P. Morgan Self-Directed Investing account with new money of $25,000 or more by moving cash, transferring securities, or rolling over existing retirement assets from another institution. Assets from J.P. Morgan Chase & Co. or its affiliates are not eligible. New money must be transferred within 45 days of enrollment date.

- At day 45 from coupon enrollment, the bonus tier will be determined in the following manner.

| New Money Inflows | Cash Bonus |

| $10,000-$24,999 | $50 |

| $25,000-$99,999 | $150 |

| $100,000-$249,999 | $325 |

| $250,000+ | $700 |

- The new money balance must be maintained in the account at 90 days from the coupon enrollment (losses due to trading or market fluctuation will not be taken into account).

- Cash bonus will be credited to the account within 15 days of these requirements being met.

- The value of the cash award may be considered income, and we may be required to send you, and file with the IRS, a Form 1099-MISC (“Miscellaneous Information”), or a Form 1042-S (“Foreign Person’s U.S. Source Income Subject to Withholding”) if applicable.

Final Thoughts

J.P. Morgan Wealth Management has now changed the bonus and funding tier but even after the change, this is a below average bonus. The positive change is that they have introduced a lower funding threshold of $10,000 for bonus but it is a measly $50 bonus.

Most people will not have $100,000 to deposit, let alone $250,000 to fund the account. They are basically offering $125 for depositing $25,000 within 45 days and holding it for 90 days. Even if you take a 90 day hold, that is a 2% annual return and currently, banks and brokerage are offering 4% return – so a $25,000 deposit will get you $250 in 90 days. We do not recommend it.