Introduction

There is a saying that resonates deeply with me – “Hope for the best and prepare for the worst”. No matter how hard or smart we work towards a better future, no one exactly knows when a future mishap might be colliding path. Sometimes, it is a mistake we made and other times, it is just plain bad luck. This is where emergency funds come in to pull you out from any kind of mishap or unexpected expenses. We hope we would not need to use but it is there in the rare chance that we need to. Having an emergency fund is the preparation for the worst.

What is an Emergency Fund?

An emergency fund is an amount of money that you set aside, only to be used during times of emergency or financial distress. The purpose of emergency fund is to improve your financial security by having the funds to cover your regular expenses in case of loss of income or to cover unexpected expenses such as medical bill, house repair, and so on.

There are three key features to be considered while building an emergency fund.

- Amount – The general consensus is to have an emergency fund that covers three to six months of your regular expenses. This fund is not built overnight but gradually over time.

- Liquidity – As the emergency fund needs to be accessed immediately when the emergency strikes, it has to be in liquid or semi-liquid assets. As such, money you have in illiquid assets such as real estate or retirement funds should not be counted towards emergency funds.

- Volatility – Emergency funds needs to be built with less volatile assets as to avoid a situation where the value of your assets is down significantly when you need to access the emergency fund. It might recover later but you need to fund now and you have less financial cushion than you thought you had. As such, stocks and especially crypts are not considered good assets to park your emergency funds.

How Do People Usually Park Their Emergency Funds?

While building an emergency fund that covers three to six months of your expenses is the key, it is also important to understand different assets that you can park it in and how your choice of assets impacts your emergency fund. . This is due to inflation and inflation, especially as high as 8% as of today, can severely erode the value of your emergency fund, if not managed properly. You might need to use the emergency fund sometime in the future and by that time, inflation would cause major decrease in the purchasing power of the amount you’ve kept aside as emergency funds.

Let’s see what most of the people keep their emergency funds in:

- Checking or Savings Accounts

Checking or Savings Accounts are the most commonly used accounts for keeping emergency fund as they provide the high liquidity that is expected of an emergency fund. Although they provide the lowest interest rate (on average) of all available options for keeping an emergency fund, the liquidity they provide is unmatched and hence, are a recommended source of keeping your emergency funds.

Note: If you are looking for Checking or Savings account with high interest, check out SoFi Checking and Savings account. They offer 1.25% APY which is the highest in the industry.

Using our Referral Link allows you to get $25 sign up bonus and the opportunity to earn $300 direct deposit bonus. Referral Link

- High Yield Saving Bank Accounts or Savings Bank

High Yield Savings Account or HYSA, as the name suggests, are savings account with higher yield (compared to most checking account). HYSA combines the liquidity of a checking account with slightly better interest rate. But with most HYSA providing less than 1% interest rate (mostly ranging between 0.5% and 0.7%), inflation, which is about 8% currently (as of April 26, 2022), will eat into most of the returns, providing a negative return in real terms.

- Money Market Accounts:

Money Market Accounts (also known as Money Market Savings Account or Money Market Deposit Account) are a special type of accounts offered by financial institutions which offers higher interest rate in exchange for minimum deposit requirement and a limit of six transaction per month (transfers & electronic payments). They are liquid accounts and can be converted to cash quickly. However, with an interest rates of less than 1% (on average), they have a negative yield in real terms.

- Certificates of Deposit (CDs)

Certificate of Deposit is a contract between you and a financial institution where you agree to deposit the money with them for fixed period for higher interest. The period can range from 3 months to 10 years. While CDs offers higher interest rate than High Yield Savings Accounts, they are also illiquid compared to HYSA and the better interest rates comes with longer deposit period. Although you can withdraw early from Certificate of Deposits, they have early withdrawal penalty that varies widely based on the financial institution and the period of CDs.

What if I tell you that there is a way to manage the emergency fund such that they remain liquid but also safe from the impact of inflation? The answer is Series I Savings Bond.

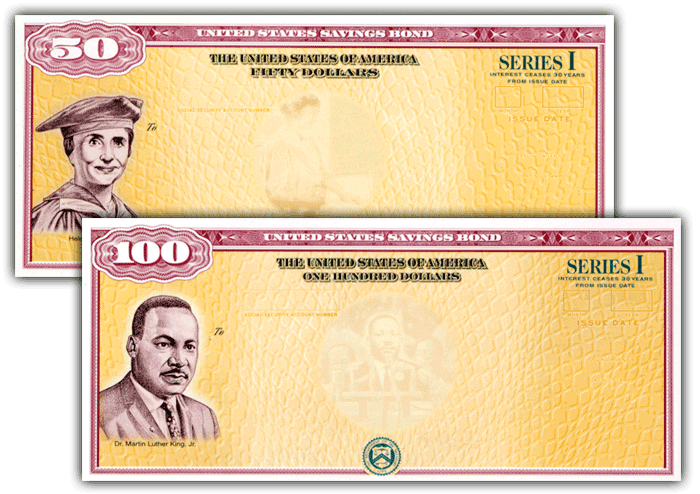

What Is Series I Savings Bond?

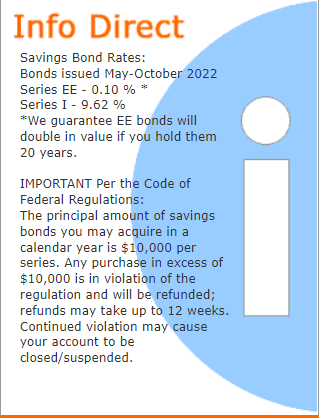

Series I Savings Bond is a U.S government savings bond that earns a fixed interest rate that stays the same for the duration of the bond and a variable interest rate that is adjusted semiannually based on the inflation rate . As the variable part of I Bond is adjusted based on inflation, it provides higher interest when inflation is high, effectively providing a hedge against inflation. The interest you earn is added to the bond monthly and is paid when you cash the bond. As of May 3, 2022, Series I Savings Bond pays out 9.62% interest.

I Bonds are issued for 30 years but has a minimum ownership term of only 1 year. That means, you can cash out the bond any time after only 1 year. If you redeem the bond before 5 years, you forfeit interest from the previous 3 months. After 5 years, there is no early redemption penalty.

I Bonds are issued as both paper and electronic bonds and can be bought for as little as 25 dollars.

Paper bonds can be purchased in any amount above $50, in $50 increments whereas Electronic bonds can be purchased in any amount above $25, in penny increments. The maximum amount of I Bonds that can be purchased in a calendar year is $5,000 for paper bonds and $10,000 for electronic bonds. The easiest way to buy I Bonds is online via TreasuryDirect.

Series I Savings Bond as Emergency Fund

When you are starting out, Series I Savings Bond would be a semi-liquid assets due to its one year ownership period and as such, your first priority needs to savings in highly liquid assets like checking account or high yield savings account. After you have some emergency fund in liquid assets, you can add I Bonds to your portfolio. It is recommended to start out small in the beginning with I Bonds (10% of your emergency fund) and gradually transfer part of your emergency fund from liquid assets to I Bond. After one year, you can buy more I Bonds since the I Bonds purchased last year is now a liquid assets. This way, within few years, you can have significant portion of your emergency funds in I Bonds which is now liquid as well as provides superior return.

Although I Bond has an early redemption penalty if you redeem if before 5 years, it is important to understand that even with early redemption penalty (forfeiture of 3 months of interest), I Bonds provide far superior returns compared to checking or savings accounts, high yield savings account, money market accounts, and Certificate of Deposits. As such, I Bonds should be part of emergency fund for all at all times but it is especially helpful during times of high inflation when its return is particularly high.

How To Buy & Redeem Them and Get The Interest?

Series I Savings Bonds can be bought directly via TreasuryDirect, an official website of U.S. Department of Treasury. You can open an account online as you would at any other financial institution, link your bank account, select the amount of I bonds you want to buy and submit your request.

After one year, I bonds can also be redeemed online via TreasuryDirect.

Conclusion

We wrote this article to familiarize you with Series I Savings Bond and how it can be strategically used to protect your emergency funds from inflation while keeping them easily accessible when in need. As most people consider bonds as illiquid assets and are not aware of the process of buying and redeeming them, they do not consider of bonds as part of their emergency fund. As such, we wanted to raise awareness about Series I Savings Bond and how it can be used to build an emergency fund that is partially inflation proof.

Disclaimer: This article was written for educational purpose only and should not be constructed as a financial advice.