Introduction

Groceries are no doubt one of the biggest part of regular household expenditures. American households spent an average of $4,942 on groceries in 2020 as per U.S. Bureau of Labor Statistics. With the current inflation, this spending in groceries is only going to get bigger and Americans are feeling further crunch in their pocket.

As grocery is one of the biggest household expenses, we set out on our quest to discover the best grocery credit cards. We analyzed all relevant credit cards that have high cash back and rewards for grocery or have offers that will result in savings at grocery store and made you our unbiased recommendation to help you save more on your regular grocery bills.

Best Grocery Credit Card – Overall

The Winner – Citi Custom Cash Card

The Citi Custom Cash Card, with its 5% cash back for Grocery, is the best cash back card for Grocery purchases – period. Most of us do not know it as such as it is not be marketed as a card for Grocery. And, it is not a card specific for Grocery. It offers 5% cash back on your top spend category, up to $500 spend per billing cycle, which adjusts automatically. Grocery is one of the categories and you can use Citi Custom Cash Card to buy only Grocery (or at least Grocery being the highest spend), getting 5% cash back on Grocery. That is a potential savings of $300 dollars each year from a card with no annual fees.

Citi Custom Cash Card offer the following cash back:

- 5% cash back on your top eligible spend category up to $500 spent each billing cycle (grocery store is one of the eligible category).

- 1% unlimited cash back on all other purchases.

The categories that are eligible for 5% includes Grocery Stores, gas stations, restaurants, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment.

With Citi Custom Cash Card, your earn cash back as Thank You points and 1 Thank You point is worth 1 cent. Reward points never expire as long as your account remains open and can be redeemed as a statement credit or direct deposit to your bank. In addition, you can redeem points for gift cards, travel, and Shop with Points at Amazon.com

Citi Custom Cash Card has no annual fees. It also offers $200 bonus when you spend $750 within first 3 months of account opening. Besides, it offers 0% APR on purchases and balance transfer for the first 15 months. As this card has no annual fees as well as offers the industry standard $200 sign up bonus, and offers 5% on Grocery (or on gas, restaurants, drugstores and so on), this is a must have card for everyone. The versatility of this card is simple unbeatable.

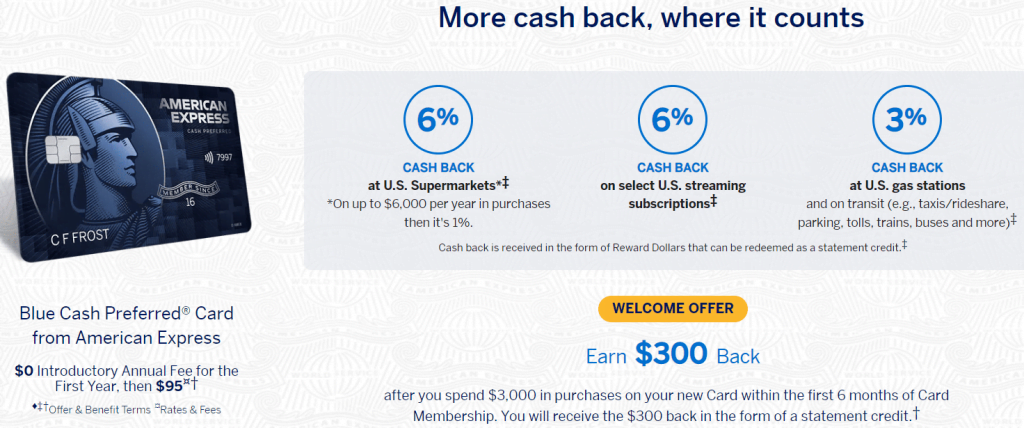

First Runner Up – Amex Blue Cash Preferred

The Amex Blue Cash Preferred offers a whopping 6% cash back at U.S Supermarkets on up to $6,000 per year in spending on groceries making it the best cash back card for groceries purchases. That is a potential savings of $360 per year. The added benefit of this card (compared to Citi Custom Cash) is that you do not need to optimize on monthly or quarterly level. The $6,000 spend limit on grocery is calculated per year, giving you the freedom to spend more on certain months or quarter. Besides cash back on groceries, Amex Blue Cash Preferred also provides solid cash back on gas, another major household expense.

Amex Blue Cash Preferred offers the following cash back:

- 6% cash back at U.S Supermarkets on up to $6,000 per year in spending (afterwards 1%).

- 6% cash back on select streaming services

- 3% on at U.S. gas stations and on transit (e.g., taxis/rideshare, parking, tolls, trains, buses and more)

- 1% cash back on all other purchases

The cash back you earned using your Amex Blue Cash Preferred is in the form of Reward dollars which can be redeemed as a statement credit. This Reward Dollar does not expire as long as your account is open and in good standing. You can redeem reward dollars for statement credits whenever your available reward dollars balance is $25 or more.

Besides solid cash back on grocery and gas spend, Amex Blue Cash Preferred provides additional benefits such as:

- Amex Offers – Eligible Card Members can redeem an Amex Offer by first enrolling in the offer in their online account or in the American Express® App and then using their enrolled Card to pay.

- Purchase Protection – Protect covered purchase made on your card against accidental damage or theft, for up to 90 days from Covered Purchase date.

- Return Protection – If you try to return an eligible item within 90 days from the date of purchase and the merchant won’t take it back, American Express may refund the full purchase price excluding shipping and handling, up to $300 per item, up to a maximum of $1,000 per calendar year per Card account.

- Extended Warranty – Extends the original manufacturer’s warranty for up to one year. The protection covers up to $10,000 per item and up to $50,000 per calendar year.

- ShopRunner membership – Complimentary ShopRunner membership that provides unlimited Free 2-Day Shipping, Free Returns, and exclusive benefits at all the stores in the network.

- Car Rental Loss and Damage Insurance – Decline the rental company’s collision insurance and charge the entire rental cost to your card. Provides secondary coverage for damage to or theft of a rental vehicle in a covered territory. Coverage is secondary to your personal insurance and does not include liability coverage.

- Premium Card Rental Protection – Pay a flat rate per rental for up to 42 consecutive days. With Premium Card Rental Protection, there is no deductible and you can file that claim with Amex as primary provider. It is a paid service.

- $120 Equinox+ Credit

- American Express Experiences – Exclusive access to tickets presales and Card Member only events in select cities.

- Amex Auto Purchasing Program

Amex Blue Cash Preferred has no annual fee for the first year but thereafter it stands at $95 per year. It also offers $300 sign up bonus when you spend $3,000 on purchases in the first 6 months of your card issuance. Apart from this, it offers an intro APR of 0% on purchases for 12 months from the date of card issuance.

We believe that the Amex Blue Cash Preferred offers excellent value to justify its annual fees. Also, it does not have an annual fee for the first year (and $95 afterwards) and excellent sign up bonus ($300). It offers not only 6% cash back on groceries but also offers and 3% on gas and 3% on select streaming services and provides myriad other benefits. This makes Amex Blue Cash Preferred a must-have card for everyone.

Best Grocery Credit Card – Rotating Category

Chase Freedom Flex

The Chase Freedom Flex provides you with the freedom as well as the flexibility on your shopping spree every quarter and groceries are no exception. It provides 5% cash back on two bonus categories which rotates every quarter and grocery is part of the bonus categories (for two quarters).

Chase Freedom Flex offers the following cash back:

- 5% cash back on up to $1,500 on combined purchases in bonus categories each quarter you activate.

- 5% cash back on travel purchased through Chase Ultimate Rewards.

- 3% cash back on dining at restaurants, including takeout and eligible delivery services.

- 3% cash back on drugstore purchases.

- 1% cash back on all other purchases.

Cash back can be redeemed for statement credit or gift cards, deposited directly to Chase bank account, or be used for travel booking at Chase Ultimate Rewards. Cash Back rewards never expires as long as your account is open and there is no such minimum limit to redeem them.

Besides the cash back, Chase Freedom Flex offers excellent additional benefits including purchase protection, extended warranty, travel insurance, and Auto Rental Collision Damage Waiver. It also offers up to $800 per claim and $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill when you pay with Chase Freedom Flex.

Chase Freedom Flex has no annual fee and gives $200 sign up bonus when you spend just $500 on purchases in the first 3 months. Additionally, you also get a 5% cash back offer on gas, for up to $6000 in purchase in the first year. It also offers 0% intro APR for 15 months from account opening on purchases and balance transfers.

Although Chase Freedom Flex provides rotating bonus categories for 5% bonus, it is a reliable card for grocery purchases as grocery is a bonus category for about two quarters each year. Besides excellent cash back on bonus categories, it offers good cash back on travel, dinning and drugstore purchases as well as excellent signup bonus.

Best Secured Credit Card for Grocery

U.S Bank Cash+ Visa Secured Card

Who says you cannot earn cash back and rewards just because you have no credit or looking to build your credit? If you happen to be one of those person building your credit score but still wants to earn credit card rewards for your grocery spend, U.S Bank Cash+ Visa Secured Card is the credit card for you. It offers 2% cash back on groceries, if you select it as one of the everyday categories. The 5% cash back category is limited to $2000 and purchases over $2000 earn 1% cash back while the 2% cash back category doesn’t have any limits.

U.S Bank Cash+ Visa Secured Card offers the following cash back:

- 5% cash back on two categories of your choice up to $2000. Available categories rotate every quarter and can be activated from their portal.

- 2% cash back on your selected everyday categories. Categories include grocery stores, restaurants, and gas & EV stations.

- 5% cash back on hotel, prepaid air, and car reservations directly in Rewards Travel Section

- 1% cash back on all other purchases

Note: Bear in mind that you need to enroll each quarter into the category of your choice before you can start to earn 5% or 2% cash back. More information at https://cashplus.usbank.com/

The U.S Bank Cash+ Visa Secured Card credit card offers more cash back when you make purchases at 1,100 online stores through the Rewards Center Earn Mall and the redemption of cash back is pretty simple as it can be easily redeemed as a statement credit, a direct deposit in your U.S. Bank savings or checking account, or a reward card. You need to have a minimum of $25 to redeem the cash back.

The U.S Bank Cash+ Visa Secured Card has no annual fee and you can start with a security deposit of $300 to $5,000. Besides having 2% on groceries, it provides 5% cash back on two categories of your selection each quarter and 5% cash back on travel purchased through their portal. It is a great card if you’re just starting with credit cards and you want to save money on groceries as well as other categories.

Best Grocery Store Credit Card – Retail

Target RedCard

The Target RedCard is the best grocery store credit card as it offers 5% off on groceries purchased from Target stores, either In-store or online. This is one of the best reward rates since it doesn’t have any preset spending limits on grocery purchases and provides a flat 5% on every purchase. This card can work as an additional card to other grocery card since most credit cards excludes Target and Walmart for higher cash back.

With Target RedCard, you can avail the following rewards:

- 5% discount on Target spends including Groceries & other purchases

- 5% discount at any in-store Starbucks location.

- 5% discount on specialty gift cards for travel, restaurants, movie tickets, and more

- 2% rewards towards Target Gift card when you spend on gas and dining

- 1% rewards towards Target Gift card when you spend on all other purchases

As this is a store card, you don’t need to go through the hassles of redemption of rewards as you directly get 5% off on eligible purchases in Target. However, purchases made with other merchants, will accumulate rewards and you can redeem it if you have earned at least $10 in rewards in the form of Target Gift Card.

Note: Even though Target RedCard claims to give 5% off on all your purchases, few purchases are excluded from the 5% off criteria such as prescriptions drugs, over-the-counter items located behind the pharmacy counter, and Target Optical Eye exams, select gift cards, and so on.

Besides the cash back and rewards, Target RedCard offers additional benefits such as:

- Extended Returns: Receive 30 additional days to return the purchases beyond the standard return policy applicable to each of the purchased items.

- Free Shipping: Receive free shipping on your Target.com purchases and free 2-day Shipping on eligible items at Target.com

- Exclusive Extras Benefits

Target RedCard has no annual fees and offers flat 5% discounts on purchases on Target. Besides the discount, it provides benefits such as extended return window, free shipping, and rewards on gas and dinning. If you’re a Target shopper, then this is a must-have card for you.

Best Grocery Store Credit Card – Wholesale

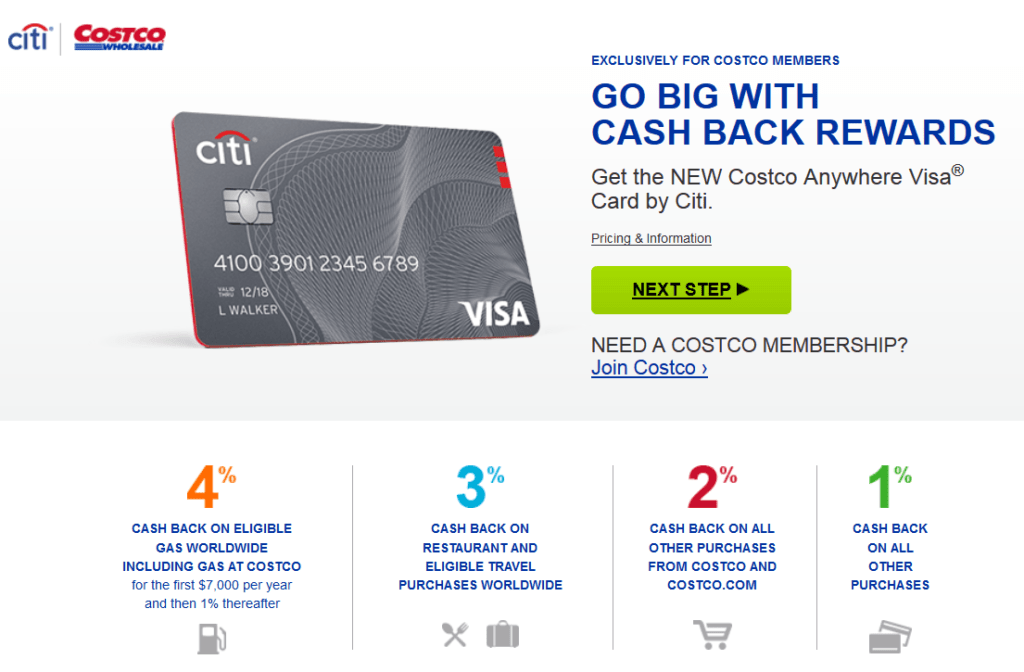

Costco Anywhere VISA Card by Citi

The Costco Anywhere Visa Card by Citi is the best grocery store credit card for wholesale purchases. It is the card you should have if you’re a Costco shopper and don’t want to miss out on 2% cash back on all purchases including groceries from Costco & costco.com. You’ll need a Costco membership to apply for this card.

Although many other cards do offer 2% flat cash back on all purchases and can compete this card, the Costco Anywhere Visa Card provides additional benefits as well. It offers the following cash back:

- 4% cash back on eligible gas, including gas at Costco for the first $7,000 per year and then 1% thereafter

- 3% on restaurants and eligible travel purchase worldwide

- 2% on all other purchases from Costco and Costco.com

- 1% on all other purchases

The cash back earned with this card is distributed back to you annually in the form of an annual credit card reward certificate. This certificate will be available once your February billing statement closes and are redeemable through December 31st of each year as either cash or merchandise.

Besides the cash back, Costco Anywhere Visa Card provide extra benefits such as Damage & Theft protection which covers any repairs or refund in case your purchases made with Costco Anywhere Visa Card are damaged or stolen within 120 days of purchase (90 days for New York residents). It also has Citi Entertainment which gives special access to purchase tickets to thousands of events, sports, and so on.

The Costco Anywhere Visa Card has no annual fee and no foreign transaction fees. Unfortunately, it does not have a sign up bonus. Despite that, Costco Anywhere Visa Card is an excellent card and a must have if you are a Costco member and spend money at Costco as well as for fuel.