Introduction

Gas prices has been on a constant rise and as of with national average currently sitting above $4 dollars a Tuesday, the average national price for a gallon of regular gasoline reached $4.17. This is the highest price ever, not accounting for inflation according to AAA. With inflation already high, American feel further crunch in their pocket with the increase in gas prices.

With Gas prices hitting record high, we set out on our quest to discover the best gas credit cards. We analyzed all relevant credit cards that have high cash back at gas or have offers that will result in savings at gas stations and made you our unbiased recommendation.

Best Gas Credit Cards

The Winner – Citi Custom Cash Card

The Citi Custom Cash Card, with its 5% cash back for Gas, is the best cash back card for Gas purchases – period. Most of us do not know it as such as it is not be marketed as a card for Gas. And, it is not a card specific for Gas. It offers 5% cash back on your top spend category, up to $500 spend per billing cycle, which adjusts automatically. Gas is one of the categories and you can use Citi Custom Cash Card to buy only Gas (or at least Gas being the highest spend), getting 5% cash back on Gas.

Citi Custom Cash Card offer the following cash back:

- 5% cash back on your top eligible spend category up to $500 spent each billing cycle

- 1% unlimited cash back on all other purchases

The categories that are eligible for 5% includes gas stations, restaurants, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment.

With Citi Custom Cash Card, your earn cash back as Thank You points and 1 Thank You point is worth 1 cent. Reward points never expire as long as your account remains open and can be redeemed as a statement credit or direct deposit to your bank. In addition, you can redeem points for gift cards, travel, and Shop with Points at Amazon.com

Citi Custom Cash Card has no annual fees. It also offers $200 bonus when you spend $700 within first 3 months of account opening. Besides, it offers 0% APR on purchases and balance transfer for the first 15 months. As this card has no annual fees as well as offers the industry standard $200 sign up bonus, and offers 5% on Gas (or on grocery, restaurants, drugstores and so on), this is a must have card for everyone.

First Runner Up – PenFed Platinum Rewards Card

The PenFed Platinum Rewards Visa Signature® Card is the second best credit card for gas purchase. It offers 5 points per dollar spent on gas stations. This is one of the best rewards that is currently offered for gas purchases. Besides 5X points on gas purchase, it also offers excellent rewards on groceries and restaurants.

PenFed Platinum Rewards Visa Signature Card offers the following rewards:

- 5 points per dollar on gas paid at the pump and EV charging stations.

- 3 points per dollar spent points on at the supermarket (including most Target and Walmart locations†), restaurants, and TV, radio, cable, streaming services

- 1 point per dollar on all other purchases.

Although PenFed Platinum Card offers 5X on gas, redemption is a bit tricky. You cannot redeem for a statement credit. As you cannot redeem for statement credit, the points are not worth 1 cent. When redeemed for gift cards or shopping, points are worth only about 0.85 cents. Points are worth as high as 1.7 cents per point when redeemed for travel. As most people will redeem for gift cards or shopping for which the points are worth only 0.85 cents, the card is offering the equivalent of 4.25% cash back.

PenFed Platinum Rewards Visa Signature® Card has no annual fees. It also offers 15,000 points bonus when you spend $1,500 within 90 days of account opening. Besides, it offers 0% APR on balance transfer for the first 12 months. For a card with no annual fee and no foreign transaction fee, 5X points on gas is a great deal. You do have to be a member of PenFed Credit Union but membership is open to all US citizens and residents (not restricted to only military and Pentagon employees) with a $5 membership fee and it has a relatively simple application process.

Second Runner Up – U.S. Bank Altitude Connect Card

US Bank Altitude Connect Card comes at a close second runner up with its 4 points per dollar spent on gas purchases. It offers a flat 4 points on every dollar spend on gas purchases and has no spending limit or cap. Points are worth 1 cents and is equivalent to getting 4% cash back. U.S. Bank Altitude Connect Visa Signature Card offers excellent points not only on gas but on travel, EV charging stations, and prepaid hotels and car rentals.

U.S. Bank Altitude Connect Visa Signature Card offers the following rewards:

- 5 points per dollar spent on prepaid hotels and car rentals booked directly in the Altitude Rewards Center.

- 4 points per dollar spent on travel, at gas stations and EV charging stations.

- 2 points per dollar spend at grocery stores, grocery delivery, dining and streaming services;

- 1 point per dollar on all other purchases.

The points never expire and can be redeemed for merchandise, gift cards, statement credit, deposit to bank account, travel and more. Besides these points, US Bank Altitude Connect Card also offers a $30 credit for annual streaming service purchases such as Netflix, Apple TV+, Spotify® and more. It also offers up to $100 in statement credits to reimburse your application fee once every four years. In terms of benefits, it also reimburses up to $600 if your cell phone is stolen or damaged when you pay your monthly cell phone bill with this card.

U.S. Bank Altitude Connect Visa Signature Card has a generous sign up bonus of 50,000 points, worth $500 when you spend $2,000 in the first 120 days of account opening. It has a $0 intro annual fee for the first year and $95/year thereafter. It has no foreign transaction fee.

Honorary Mention – BofA Customized Cash Rewards Card

Bank of America Customized Cash Rewards Card is a customizable rewards credit card where you can select a category to receive 3% cash back, with gas being one of those categories. Besides 3% cash back on the category of your choice, it offers 2% cash back at grocery stores and wholesale clubs. There is a spending limit of $2500 per quarter that is eligible for the 3% and 2% cash back (3% for category of your choice and 2% of grocery stores and wholesale clubs). The best part about BofA Customized Cash Rewards Card is that Preferred Rewards member can earn 25% – 75% more cash back, meaning the 3% choice category could go up to 5.25% cash back.

BofA Customized Cash Rewards Card offers the following cashback:

- 3% cash back in the category of your choice – gas, online shopping, dining, travel, drug stores or home improvements & furnishings

- 2% cash back automatically at grocery stores and wholesale clubs

- 1% unlimited cash back on all other purchases

Cash back do not expire and can be easily redeemed for statement credit, deposit to Bank of America Checking or Savings account or for credit to an eligible account with Merrill.

BofA Customized Cash Rewards Card has no annual fees. It also offers $200 bonus when you spend $1,000 within first 90 days of account opening. Besides, it offers 0% APR on purchases and balance transfer for the first 15 months. If you are a member of Preferred Rewards with Platinum Honors status, BofA Customized Cash Rewards Card is the best cash back credit card for gas.

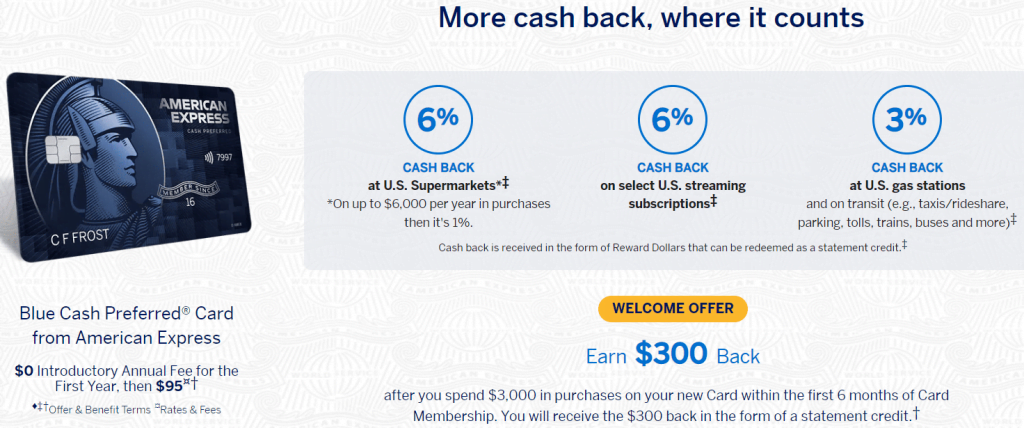

Best Amex Card for Gas – Amex Blue Cash Preferred Card

Amex Blue Cash Preferred is the best Amex Card for Gas as it offers 3% flat cash back on gas purchases and has no monthly or quarterly spending limit. Besides Gas, Amex Blue Cash Preferred offers excellent cash back for groceries, streaming services, and on transit.

Amex Blue Cash Preferred Card offers the following cashback:

- Earn 6% cash back on your first $6,000 of purchases per year at US supermarkets (excludes Walmart and Target).

- Earn 6% cash back on select streaming service

- Earn 3% cash back at US Gas Stations and on transit (e.g., taxis/rideshare, parking, tolls, trains, buses and more)

- Earn 1% on all other purchases

Cash back is received in the form of Reward Dollars that can be redeemed for statement credits whenever your available balance is $25 or more. Besides the cash back, Amex Blue Cash Preferred Card offers additional benefits including purchase protection, return protection, extended warranty, Car Rental Loss and Damage Insurance. Additionally, it offers a $120 Equinox+ Credit per year and a complimentary ShopRunner membership to its cardholder. It also offers 0% intro APR on purchases for 12 months from account opening.

Amex Blue Cash Preferred Card has a generous sign up bonus of $300, when you spend $3,000 in the first 6 months of account opening. It has a $0 intro annual fee for the first year and $95/year thereafter.

Best Chase Card for Gas – Chase Freedom Flex

Chase Freedom Flex is the best Chase Card for Gas as it currently offers 5% flat cash back on gas purchase, up to $6,000 with in the first year. Besides, it offers a 5% cash back in two categories that rotates each quarter and gas is offered as the category every year. Besides Gas, Chase Freedom Flex offers excellent cash back on travel as well as dining and drugstore purchases.

Chase Freedom Flex offers following cashback:

- Earn 5% on up to $1,500 on combined purchases in bonus categories each quarter you activate.

- Earn 5% on travel purchased through Chase Ultimate Rewards.

- Earn 3% on dining at restaurants, including takeout and eligible delivery services

- Earn 3% on drugstore purchases

- Earn 1% on all other purchases.

Cash Back rewards do not expire as long as your account is open. And there is no minimum to redeem for cash back. Cash back can be redeemed for statement credit or gift cards, deposited directly to Chase bank account, or be used for travel booking at Chase Ultimate Rewards. Besides the cash back, Chase Freedom Flex offers excellent additional benefits including purchase protection, extended warranty, travel insurance, and Auto Rental Collision Damage Waiver. It also offers up to $800 per claim and $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill when you pay with Chase Freedom Flex.

Chase Freedom Flex has no annual fees and offers $200 sign up bonus after spending $500 within the first 3 months of account opening. It also offers 0% intro APR for 15 months from account opening on purchases and balance transfers.

Note: Although currently both Chase Freedom Flex and Chase Freedom Unlimited offers 5% cash back on gas, for up to $6000 spent on purchase within first year, Chase Freedom Flex also offers gas as a 5% rotating category, at least once a year.