Wells Fargo Autograph Bonus Updates

Update on January 29, 2023 – Wells Fargo has now reduced the sign up bonus to $200. You need to spend $1,000 within the first 3 months to earn that bonus.

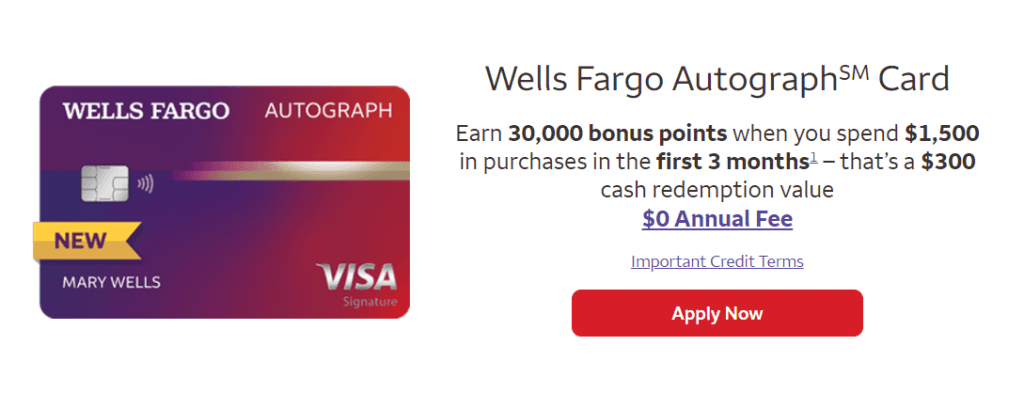

Wells Fargo Autograph Card

Wells Fargo is offering a $300 sign up bonus for Wells Fargo Autograph Card. To be eligible, you have to spend $1500 on purchases in the first 3 months from account opening.

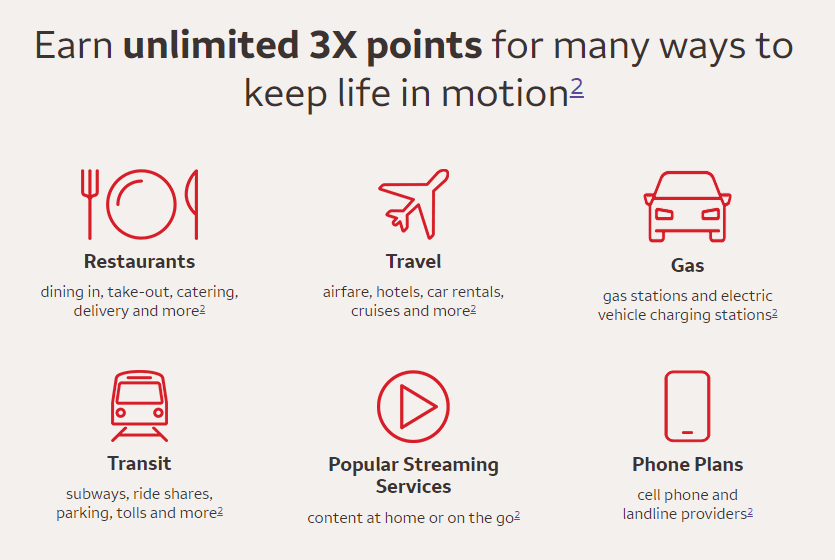

Wells Fargo Autograph Card offers unlimited 3% cash back on restaurants, travel, gas, transit, popular streaming services, and phone plans and 1% cash back on all other purchases. There is no limit to the amount of cash back you can earn. Cash rewards are easy to redeem and don’t expire.

Rewards Redemption

- Redeem for purchases – Redeem rewards to offset eligible purchases made on your credit card account. Redeem for purchases as little as $1.

- Redeem to account – Redeem your rewards as a credit to a qualifying Wells Fargo credit card, checking account, or mortgage.

- Redeem for Gift Cards – Find the perfect card for that right occasion. Cards are redeemable in $25 increments.

- Redeem for travel – Redeem your rewards on flights, car rentals, and hotel stays for your next vacation.

- Pay with Rewards through PayPal – Shop at millions of online stores and redeem your rewards when you check out with PayPal.

Wells Fargo Autograph Card Bonus Summary

Bonus – $300

Required Spend – $1,500 within the first 3 months of account opening

Additional Offer – 0% intro APR for 12 months from account opening on purchases and balance transfers

Offer Expiry – No Information

Annual Fee – $0 (None)

Link for the Offer

Additional Card Benefits

- Cell Phone Protection – Get up to $600 of protection against damage or theft when you pay your monthly cell phone bill with Wells Fargo Autograph Card (subject to a $25 deductible).

- Auto Rental Collison Damage Waiver – Covers theft, damage, valid loss-of-use charges imposed and substantiated by the rental company, administrative fees and reasonable and customary towing charges to the nearest qualified repair facility.

- Travel and emergency services assistance – Offers emergency assistance and referral services designed to help you in case of an emergency while traveling.

- Emergency cash disbursement and card replacement – A 24/7 on-demand referral dispatch network that provides emergency roadside assistance, towing, or locksmith service when you need them.

- My Wells Fargo Deals – An easy way to earn cash back in the form of a statement credit while you shop, dine, or enjoy an experience simply by using your eligible Wells Fargo Credit Card. Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants.

Besides, Wells Fargo Autograph Card is a Visa Signature and comes with Visa Signature benefit such as 24/7 Concierge Service and Luxury Hotel Collection.

Our Review of Best Cash Back Credit Cards

Our List of Best Credit Card Bonuses

The Fine Print

You may not qualify for an additional Wells Fargo credit card if you have opened a Wells Fargo credit card in the last 6 months.

- To qualify for the 30,000 bonus rewards points, a total of at least $1,500 in net purchases (purchases minus returns/credits) must post to your account within 3 months from the date your account is opened. These bonus rewards points will show as redeemable within 1 – 2 billing periods after they are earned. Cash advances and balance transfers do not apply for purposes of this offer and may affect the credit line available for this offer. ATM transactions, cash advances of any kind, balance transfers, SUPERCHECKS, cash equivalents such as money orders and prepaid gift cards, casino gaming chips, wire transfers, off-track wagers, lottery tickets, or bets or wagers transmitted over the internet, fees or interest posted to a linked account, including but not limited to returned payment fees, late fees, and monthly or annual fees, do not earn rewards points.

- Three rewards points (1 base point plus 2 bonus points) are earned per $1 spent on net purchases (purchases minus returns/credits) at retailers whose VISA® merchant code is classified as: Travel: airline, hotel/motel, timeshare, or vehicle/auto rental, cruise lines, travel agencies, discount travel sites, campgrounds. Transit: passenger railway, taxis, limousines, ferries, toll bridges and highways, parking lots and garages. Gas: gas stations, automated fuel dispensers, and electric vehicle charging stations. Dining: eating places and restaurants, drinking places, fast food restaurants, and/or caterers. Phone plans: landline and cell phone providers considered telecommunication services. Popular streaming services: cable and other pay television, digital goods, books, movie, music, and continuity/subscription services, as listed at: wellsfargo.com/autographstreaming. Other purchases: 1 rewards point will be earned per $1 spent on other net purchases. Cash equivalents do not earn points.

Final Thoughts

Another excellent offering from Wells Fargo. Previously, we had mentioned that Wells Fargo is upping its game in credit cards with Wells Fargo Active Cash and Bilt MasterCard and this card is an excellent addition to their offering. It offers solid 3% on a lot of categories where consumers spend money. Grocery is the only major category that is missing. Besides, it does not have a limit on how much cashback you can earn in a month or a year.

$300 cashback after spending $1,500 within 3 months is an excellent deal. We do recommend it.