Amex Blue Cash Everyday Card

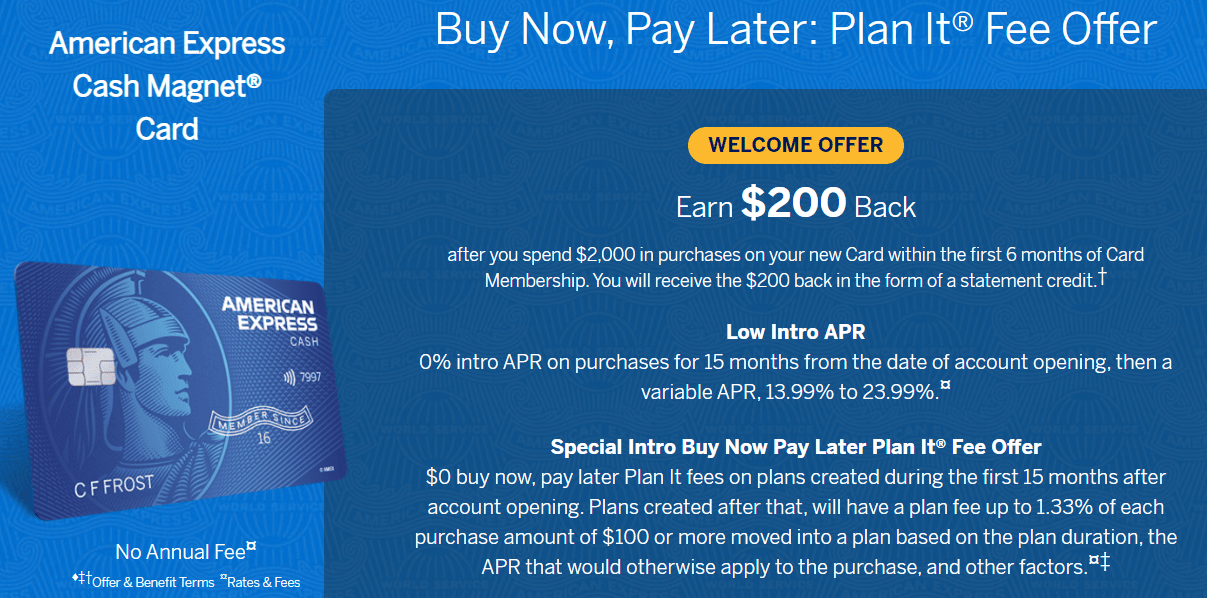

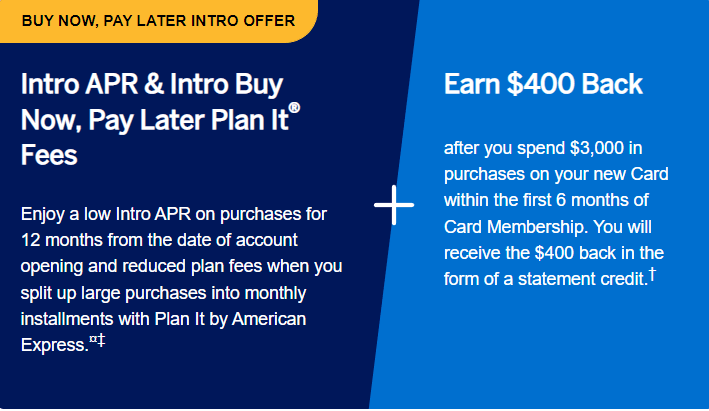

American Express is offering $200 sign up bonus for Amex Blue Cash Everyday Card. To be eligible, you have to spend $2,000 on purchases in the first 6 months from account opening.

With our referral, the welcome bonus for Amex Blue Cash Everyday is increased to $250 from $200. Both direct link and referral link is mentioned.

Amex Blue Cash Everyday Card offers the following cashback:

- Earn 3% on your first $6,000 of purchases per year at US supermarkets (excludes Walmart & Target).

- Earn 3% at US Gas Stations.

- Earn 3% at US online retail purchases

- Earn 1% on all other purchases

Cash back is received in the form of Reward Dollars that can be redeemed for statement credits.

Amex Blue Cash Everyday Bonus Summary

Bonus – $200

Required Spend – $2,000 within the first 6 months of account opening

Additional Offer – 0% intro APR for 15 months from account opening on purchases

Offer Expiry – No Information

Annual Fee – $0 (None)

Link for the Offer

In case you would like to use our referral link for the exact same offer (or at times $250 offer), here is Our Referral Link

Additional Benefits

- Amex Offers – Eligible Card Members can redeem an Amex Offer by first enrolling in the offer in their online account or in the American Express® App and then using their enrolled Card to pay.

- Disney Bundle –Receive $7 back each month (up to $84 back annually) after spending $13.99 or more each month on an eligible subscription to The Disney Bundle which includes Disney+, Hulu, and ESPN+ using your Card.

- Home Chef Credit – Make cooking at home even more enjoyable. Receive up to $15 per month in statement credits when you purchase Home Chef meal solutions online with your enrolled Blue Cash Everyday Card.

- Purchase Protection – Protect covered purchase made on your card against accidental damage or theft, for up to 90 days from Covered Purchase date.

- Car Rental Loss and Damage Insurance – Decline the rental company’s collision insurance and charge the entire rental cost to your card. Provides secondary coverage for damage to or theft of a rental vehicle in a covered territory. Coverage is secondary to your personal insurance and does not include liability coverage.

- Premium Card Rental Protection – Pay a flat rate per rental for up to 42 consecutive days. With Premium Card Rental Protection, there is no deductible and you can file that claim with Amex as primary provider. It is a paid service.

- ShopRunner membership – Complimentary ShopRunner membership that provides unlimited Free 2-Day Shipping, Free Returns, and exclusive benefits at all the stores in the network.

- American Express Experiences – Exclusive access to tickets presales and Card Member only events in select cities.

- Amex Auto Purchasing Program

Our Review of Best Cash Back Credit Cards

BonusCoach’s List of Best Credit Card Bonus

The Fine Print

The welcome offer, intro APRs, and intro plan fees are not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer, intro APRs, and intro plan fee eligibility.

$200 Statement Credit

To qualify for the $200 statement credit, you must make purchases with your Blue Cash Everyday® Card from American Express that total $2,000 or more within your first 6 months of Card Membership starting from the date your account is approved. The statement credit will be applied 8-12 weeks after the spend threshold is met. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit the welcome offer to, we may freeze the welcome offer credited to, or we may take away the welcome offer from your account. We may also cancel this Card account and other Card accounts you may have with us.

Eligible purchases can be made by the Basic Card Member and any Additional Card Members on a single Card Account. Purchases to meet the spend requirement do NOT include fees or interest charges, cash advances, purchases of traveler’s checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of any cash equivalents. Additional Card Members on your account are not eligible for this offer. To receive the $200 statement credit, your Card account must not be past due or cancelled at the time the statement credit is posted to your Card account.

Final Thoughts

American Express Blue Cash is an excellent card, especially after the recent changes. $200 bonus after spending $2000 is below average as most of its peer offer $200 bonus but with lower spend requirements. However, this card is a great card to have, for 3% on grocery and gas and with additional features such as Purchase Protection, Disney Bundle, and Amex Offers.