Chase Bank Bonus Updates

Update on January 13, 2023 – Chase has an alternative offer where they are offering $900 bonus for their Checking & Savings account. We recommend you to use that one. Link – $900 Chase Checking Savings Bonus

Update on January 12, 2023 – Chase has extended the bonus till 4/19/2023.

Chase Bank

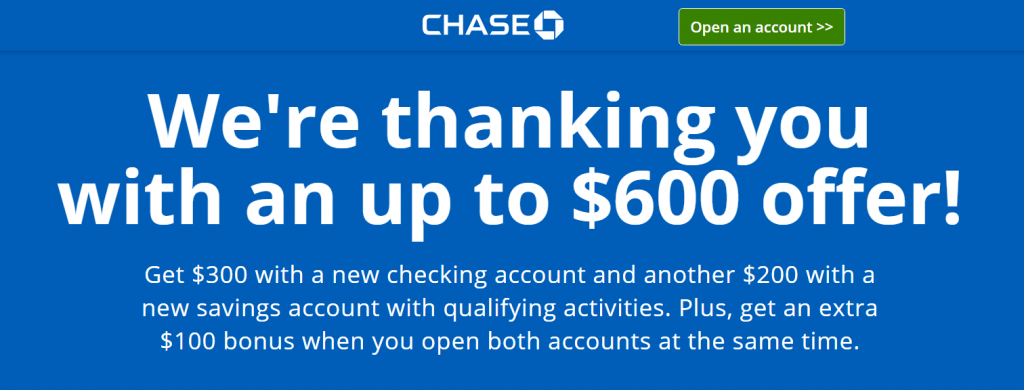

Chase is now offering a $600 bonus when you open a checking and a savings account with them. The offer is valid both online and at Chase branches (you need to get the code from the link and take it to the branch). To be eligible, you need to open the checking account and setup a direct deposit within 90 days of account opening as well as open a savings account and deposit $15,000 in new money within 30 days of account opening.

This bonus is also valid for individual account. You can only open Checking account for $300 bonus or Savings account for $200 bonus or both for a combined bonus of $600.

Chase $600 Bonus (Checking+Savings) Summary

Bonus – $600 ($300 checking, $200 savings, & $100 extra)

Account – Checking and Savings

Direct Deposit – Yes, any amount within 90 days for Checking account. Deposit $15,000 for Savings account.

Availability – Nationwide (both online and at branches)

Offer Expiry – January 25, 2023

Account Fees – $12 monthly for checking and $5 monthly for savings, both waivable (See below on how to avoid it)

Link for the Offer

Chase Bonus Requirements

- Open the Chase Total Checking® account online using the link or at Chase branches with the coupon you receive at your email

- Open Chase Savings account

- Get qualifying direct deposit of within 90 days of account opening for checking account.

- Deposit a total of $15,000 or more in new money within 30 days of coupon enrollment, and maintain a $15,000 balance for 90 days from coupon enrollment.

- Receive your money within 15 days.

Chase Account Fees | How to Avoid It?

Chase Total Checking® Account charges $12 monthly service fees.

The monthly service fee can be avoided with one of the following each fee period:

- Have electronic deposits made into this account totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment network, or (iii) third party services that facilitate payments to your debit card using the Visa® or Mastercard® network; OR,

- Keep a balance at the beginning of each day of $1,500 or more in your checking account; OR,

- Keep an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings and other balances.

Chase Savings® Account charges $5 monthly service fees.

The monthly service fee can be avoided with one of the following each fee period:

- A balance at the beginning of each day of $300 or more in this account; OR,

- $25 or more in total Autosave or other repeating automatic transfers from your personal Chase checking account (available only through chase.com or Chase Mobile®)

Early Account Termination Fees

There is no mention of early termination fees. If the checking account is closed by the customer or Chase within six months after coupon enrollment, Chase will deduct the bonus amount at closing.

The Fine Print

- Bonus/Account Information: Checking offer is not available to existing Chase checking customers. Savings offer is not available to existing Chase savings customers. Both offers are not available to those whose accounts have been closed within 90 days or closed with a negative balance within the last 3 years. You can receive only one new checking and one new savings account opening related bonus every two years from the last coupon enrollment date and only one bonus per account. Coupon is good for one-time use.

- To receive the checking bonus: 1) Open a new Chase Total Checking account, which is subject to approval; AND 2) Have your direct deposit made to this account within 90 days of coupon enrollment. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government. Person to Person payments (such as Zelle®) are not considered a direct deposit. Micro-deposits do not qualify as a direct deposit for the bonus. Micro-deposits are small deposits, typically less than $1, that are sent to your account to verify it is the correct account. After you have completed all the above checking requirements, we’ll deposit the bonus in your new account within 15 days.

- To receive the savings bonus: 1) Open a new Chase Savings account, which is subject to approval; 2) Deposit a total of $15,000 or more in new money into the new savings account within 30 days of coupon enrollment; AND 3) Maintain at least a $15,000 balance for 90 days from the coupon enrollment. The new money cannot be funds held by you at Chase or its affiliates. After you have completed all the above savings requirements, we’ll deposit the bonus in your new account within 15 days.

- To receive the extra bonus: You must open the checking and savings account at the same time and complete all requirements above for BOTH the checking bonus and savings bonus. After you have completed all requirements, we will deposit the remaining bonus due in your new account within 15 days. To receive any of the above bonuses, the enrolled account must not be closed or restricted at the time of payout.

- Bonuses are considered interest and will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

- Account Closing: If either the checking or savings account is closed by the customer or Chase within six months after coupon enrollment, we will deduct the bonus amount for that account at closing.

Final Thoughts

Chase $600 bonus is the best bonus Chase is offering currently. What’s good about it is that you can only apply for Checking account for $300 bonus which is better than the one they are offering independently ($200).